when is tax season 2022 canada

It is postmarked on or before May 2 2022. Instalment payments due dates for 2022.

If April 30 falls on a weekend the CRA extends the deadline to the following business day.

. Canadians with low or fixed incomes. Temporary expansion to the eligibility for the Local Lockdown Program periods 24 25 2022-02-03. You can file before this date and get ahead of the queue.

2022 Income Tax in Canada is calculated separately for Federal tax commitments and Province Tax commitments depending on where the individual tax return is filed in 2022 due to work location. The Canada Revenue Agency usually expects individual taxpayers to submit their income tax returns by April 30 of every year. Non-resident tax return deadline.

Filing deadline for most individuals is April 30 2022. We receive it on or before May 2 2022. Because April 30 our usual tax deadline falls on a Saturday The Canada Revenue Agency will extend the deadline to the next business day which will be May 2 2022.

The first day you can file your taxes in. The deadline for filing a tax return for the 2021 tax year is 2 May 2022. It can be a bit confusing but in 2022 you should do your taxes for the.

For instance Emmas 2021 and 2022 taxable income remains. If you filed a paper return last tax season in Canada the CRA should automatically mail you the 2021 income tax package by the end of February. The tax documenting cutoff time for most Canadians for the 2021 fiscal year is on April 30 2022.

April 30 2022 extended to May 2 nd Tax filing deadline for self-employed individuals. The Canada Revenue Agency CRA is committed to making sure residents of Quebec get the benefits and credits they are entitled to. In 2022 the RRSP dollar limit increased to 29210.

What you need to know for the 2022 tax-filing season. Regularly the overall expense documenting cutoff time date is on April 30th every year except in 2022 this date falls. The 2022 tax filing season opens on 1 july.

The Canadian tax year runs from. Tax Changes in 2022. The 2022 tax filing season in Canada kicked off on February 21 2022.

E-filing open for resident and immigrants in Canada for 2021 tax year. Tax season 2022 what day does it start and until when can i send my documents as usa hopes ucr in. Remember that your RRSP contribution limit is capped at 18 of your earned income in the previous year.

Avoid last minute delays at tax time by setting up My Account. Whether youre looking for the deadline to file personal tax or the penalties rate for late filing to avoid youve come to the right place. The personal and business tax filing deadline 2022 Canada is not too far off and the season will start off in February 2022.

The 2022 Tax Year in Canada runs from January 2022 to December 2022 with individual tax returns due no later than the following April 30 th 2023. Federal Tax Bracket Rates for 2021. Tax deadline is extended kind of Last year the CRA surprised everyone when they didnt extend the.

The tax filing deadline for your 2021 tax return is May 2 2022. According to the Canada Revenue Agency CRA Canadians permanent residents workers and international students who had income in 2021 are required to submit their tax filing by 30 April 2022. It is now officially Tax Season 2022 in Vancouver Canada.

The tax-filing deadline for most Canadians for the 2021 tax year is on April 30 2022. 15 on the first 49020 of taxable income and. Remember that May 2 2022 is actually the tax deadline for last years taxes 2021.

The tax deadline in Canada every year is April 30. This years tax return 2022 deadline has changed. Deadline to set up a pre-authorized debit payments for.

The Canada Revenue Agency CRA wants to help you and your clients prepare to file their income tax and benefit return this year. Installment payment for individuals. This means the dollar limit is the maximum amount you can contribute regardless of your income.

2022 Canada Tax Season Deadlines Penalties After a long year with lots of changes to the way we run our businesses due to COVID the 2022 tax season is on the horizon. 205 on the portion of taxable income over 49020 up to 98040 and. For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022.

The basic personal amount is up to 14398. The federal income tax brackets increased in 2022 based on an indexation rate of 24. All non-residents and emigrants from Canada should file.

The RRSP annual dollar limit for tax year 2021 is 27830. Normally the general tax filing deadline date is on April 30th each year but in 2022 this date falls on a Saturday so theres an extension until the next business day which is May 2. If you want to file early the CRA will open its NETFILE service.

May 2 2022 or June 15 2022 if a spouse is self-employed. Due to the continued challenges of COVID-19 this will be another particular tax-filing season. February 21 2022 Montreal Quebec Canada Revenue Agency.

Last day to issue T4s T4As and T5s to employers and CRA Canada Revenue Agency. The Deadline for the Fiscal Year 2021 Personal Tax Returns will be May 2 2022. However you dont have to wait until April to file your Canadian tax return.

Mail-in a paper copy. Heres what Canadians should know about the oddities surrounding the 2022 tax season. The 2022 tax filing season opens on 1 july.

But for 2022 this date is a Saturday so were getting a little extension May 2 2022 is our official tax deadline this year. Since April 30 2022 falls on a Saturday your income tax and benefit return will be considered filed on time in either of the following situations. This new tax season will have a new deadline date on May 2 2022.

Federal Tax Rate Brackets in 2022. File by Phone. The tax-filing deadline for most individuals is April 30 2022.

However only residents and immigrants in Canada are allowed to apply online. March 15 June 15 September 15 and December 15. Otherwise you can view and download forms from the CRA website starting Jan.

This new tax season will have a new deadline date on may 2 2022. The CRA has increased the 2022 age amount by 185 to 7898 which will reduce your federal tax bill by 1185 15 of 7898. 15 March 2022 15 June 2022 15 September 2021 15 December 2022.

The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA. Since April 30 2022 falls on a Saturday your clients return will be considered filed on time in either of the following situations. You have until June 15 2022 to file your tax return if.

26 on the portion of taxable income over 98040 up to 151978 and. NETFILE opens on February 21 2022.

Tops W 2 Tax Forms 6 Part Carbonless 5 1 2 X 8 1 2 24 W 2s 1 W 3 Size 1 2 Inch X 5 Multicolor In 2022 Tax Forms Money Template Tax

How Uber Drivers Pay Less Hst In 2022 Uber Driver Tax Services Uber

Jewish Art Calendar 2022 By Mickie Caspi Cards Art Art Calendar Jewish Art Art

Seagull Pewter Bird Pin Vintage Pewter Brooch Seagull Etsy Canada In 2022 Bird Brooch Gifts For Mom Vintage Jewels

Tax And Financial Management Taxes Seaso Premium Photo Freepik Photo Background Business Money Text Tax Rules Financial Management Income Tax

Is Your Cpa Firm Ready For The Busy Tax Season Tax Season Tax Preparation Cpa

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Save Money With These 5 Year End Tax Tips In May 2022 Ourfamilyworld Com Canadian Money Canadian Things Canada

Should I Do My Own Taxes Savings And Sangria Money Advice Tax Time Tax

Tax Filing Season 2022 What To Do Before January 24 Marca

Happy Sunday In 2022 Happy Sunday Happy Staying Positive

Master Your Mortgage For Financial Freedom How To Use The Smith Manoeuvre In Canada To Make Your Mortgage Tax Deductible And Create Wealth In 2022 Financial Freedom Tax Deductions Financial Strategies

Amor Furniture On Instagram Tax Season Special Amor Furniturect 2115 Dixwell Ave Hamden Ct 06514 347 798 7994 We Deliver In 2022 Furniture Chaise Lounge Home

Striped Scholar Roll Labels Tall Rectangle Labels Evermine Roll Labels Labels Scholar

Here Are Some Tips To Save On Your Income Taxes According To An Ontario Tax Expert In 2022 Tax Free Savings Income Tax Tax Deductions

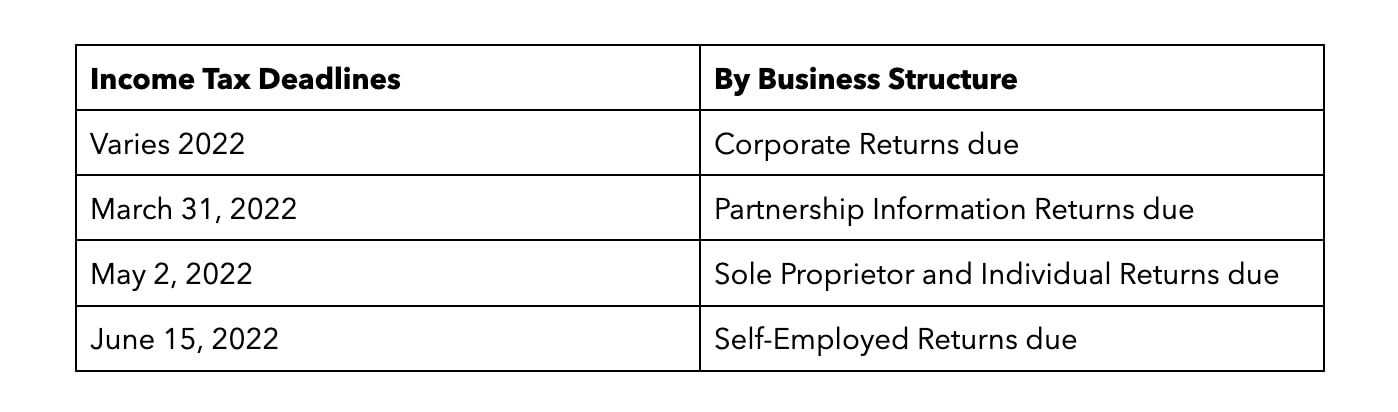

When Are Small Business Taxes Due Quickbooks Canada

Printable Tax Deduction Log Digital Downloadable Etsy Canada In 2022 Tax Deductions Deduction Printed Sheets